“Redefining Flexibility: How Ratio Tech’s BNPL Empowers SaaS and Hardware Sales”

Redefining Flexibility: How BNPL Empowers SaaS and Hardware Sales

BNPL helps B2B buyers close sales faster and increase their ACV more easily by making annual subscription plans more cost-effective, eliminating the need for merchants to offer significant discounts or face an unpredictable cash cycle.

BNPL also appeals to younger, digital-native consumers who value flexibility and financial prudence. With its user-friendly interface and instant credit decisions, this payment method makes its services accessible to a broad base.

Introduction to BNPL in the Tech Industry

Buy now, pay later (BNPL), is becoming increasingly popular among consumers in recent years. This payment option enables consumers to finance online purchases with installment payments rather than forking over full amounts upfront.

COVID-19 propelled its rise, as many credit card users found themselves with declining limits and higher interest rates. Its widespread adoption also helped facilitate growth for Fintech companies such as Klarna, Afterpay and Affirm.

BNPL providers provide an easier alternative to invoice financing that doesn't involve lengthy credit applications; their proprietary apps provide a quick and smooth approval process, helping reduce cart abandonment and close sales faster while relieving vendors of stress related to potential default by shifting it onto third parties – this makes accepting payments from buyers with imperfect credit easier and manage collections, reminders, billing to prevent debt delinquency issues from emerging.

Integrating BNPL in the B2B Sales Process

B2B companies can increase revenue and remain competitive by incorporating BNPL into their sales process. Not only can it speed up sales while simultaneously improving cash flow, BNPL can also reduce credit risk associated with traditional trade credit agreements.

When businesses purchase your product, they often need to go through multiple approval processes and logistical hurdles before hitting "buy." This process can be time-consuming if the price tag is steep, leading many B2B buyers to hesitate purchasing your offering. With BNPL's flexible payment terms that feel like discounts, this barrier to conversion can easily be overcome.

BNPL allows sellers to increase revenue by shifting financing costs to buyers instead, with zero vendor financing benefits contributing to faster renewals, higher closure rates, and decreased churn.

Empowering SaaS Companies with Flexible Financing

BNPL gives buyers the ability to pay interest-free installments over an agreed upon period. It works like a point-of-sale credit plan that enables customers to make a down payment and then spread out payments over several months or years. US non-dilutive growth capital provider Capchase recently unveiled a B2B BNPL solution known as Capchase Pay specifically tailored for SaaS companies that hopes to shorten sales cycles and close new contracts faster.

Integrating BNPL into the checkout process enables vendors to offer this flexible financing option and convert more potential customers to clients. Furthermore, its ability to facilitate payments over time may ease cash-flow issues for enterprise buyers in an ever-tightening market environment. Finally, using this financing model along with predictive pricing and frictionless quote to cash platforms provides SaaS vendors with new growth tools in a highly competitive tech market environment.

Revolutionizing Hardware Sales Through BNPL

BNPLfor B2B has become increasingly popular in shopping cart abandonment cases and sales, but can also revolutionize SaaS hardware sales by increasing total contract value (TCV) and streamlining quote-to-cash processes. As an effective financing solution, it allows customers to split the costs of purchases into manageable installments over an extended period.

BNPL plans differ from credit cards in that they often don't charge interest on time payments and they often break purchases up into fixed monthly installments so as not to feel financially strainful when purchasing expensive items.

However, it's essential to select a reliable buy now pay later service provider with reasonable fees and consumer protection policies. Check online reviews as well as compliance with privacy and data laws of any potential providers before looking for partners that integrate seamlessly with Stripe platform.

Case Studies: Real-World Impact of BNPL on Tech Sales

Transforming Trucking: A Ratio Tech BNPL Success Story

One of Ratio Tech's notable case studies involves a startup trucking company, now a multi-billion dollar enterprise, that utilized Ratio Tech's BNPL solutions to manage its financial operations effectively. By integrating BNPL, the company was able to offer flexible financing to their clients, particularly smaller companies that faced challenges with traditional credit systems. This flexibility not only helped them secure sales but also removed the debt liability from their books, improving their overall financial health and attractiveness to investors. The CEO of the trucking company noted, "By using Ratio Tech’s BNPL capabilities, we were able to increase our sales by approximately 30% compared to our previous models."

An interview with Victor Thu, CMO of Ratio Tech, further explains the value created below:

"There's this startup trucking company which is a multi billion dollar company using Ratio Tech. They actually have both the hardware and the software component. When they're dealing with much larger clients, they are happy to provide financing mechanisms because the value is much higher. Also, their clients are larger enterprises which have the ability to come up with their own financing. However for smaller companies, they don't want to necessarily provide that financing because whenever they do that work it's it becomes the liability or debt against the financial book and it doesn't look as attractive for people who might be investing in them and looking at the massive viable business. So when Ratio Tech became the financing engine for their smaller clients, they removed a lot of the debt liability from their financial books and are still able to collect cash up front. That's how we are helping one of our clients in using a buy now pay later capability for B2B."

This example demonstrates how BNPL solutions can facilitate significant business growth by providing more manageable payment options to customers, enhancing both the buyer's and seller's financial stability and market competitiveness.

Integrating Traditional Financial Solutions: Accounts Receivable Factoring vs. BNPL

Understanding Accounts Receivable Factoring

Accounts receivable factoring is a financial method where businesses sell their invoices to a third party at a discount to obtain immediate cash. This approach is traditionally utilized to enhance cash flow and reduce credit risk from delayed customer payments.

Contrasting with BNPL

Unlike factoring, Buy Now, Pay Later (BNPL) solutions offered by companies like Ratio Tech do not require the selling of receivables. BNPL allows customers to defer payments, which enables businesses to maintain full revenue from sales without immediate financial drawbacks. This contrast highlights BNPL's flexibility and its less intrusive impact on business finances compared to traditional factoring.

Benefits of BNPL for B2B

BNPL solutions extend several advantages over accounts receivable factoring, including improved cash flow management without sacrificing potential income or customer relations. By offering deferred payment options, BNPL enhances buyer satisfaction and loyalty, which is crucial for long-term business growth.

Case Study Insight

Consider the example of a tech company that implemented Ratio Tech’s BNPL solutions to streamline hardware sales. The company was able to offer flexible payment plans without reducing the invoice value, contrasting significantly with their previous factoring arrangements which impacted their bottom line due to the discounting of invoices.

Strategic Implications

For businesses weighing the pros and cons of financial strategies, BNPL presents a modern alternative that aligns with digital transformation goals and customer-centric sales models. This method supports sustainable business growth by accommodating both current market trends and consumer preferences for payment flexibility.

Incorporating BNPL alongside or as a replacement for traditional factoring can significantly transform how businesses manage sales and finance, making it an essential consideration for companies looking to innovate their financial operations and enhance market competitiveness.

Comparative Analysis: BNPL vs. Traditional Credit

BNPL (Buy Now Pay Later) financing allows consumers to pay for purchases over time with no interest accruing, often integrated directly into a retailer's checkout process and available as an option alongside traditional payment methods such as Klarna, AfterPay or Affirm.

As opposed to credit cards, most BNPLs don't report spending and payment activity to major credit bureaus; however, responsible spending habits could still help consumers build strong credit histories and enhance their overall score.

While BNPL presents an opportunity to boost B2B sales through flexible purchase terms, it also comes with risks. As many BNPL users are younger individuals without extensive credit histories or histories that don't apply, their high utilization rates could result in delinquency or default. To minimize these risks, an effective credit decisioning process must be in place. AI/ML models have proven their worth in successfully processing credit card applications – an asset AI can bring when applied to BNPL as well.

Future Trends: BNPL Evolving Tech Market

BNPL continues to gain in popularity among consumers. Generation Z and Millennial shoppers use this technology more frequently than their elders, even though they tend to be less comfortable with traditional credit. They find the flexibility and certainty offered by buy now, pay later more appealing than credit cards' potential for debt accumulation.

However, despite its widespread appeal, some BNPL services still face profitability hurdles due to high operating costs for marketing, administrative and technology expenses (Payments Dive 2023). Furthermore, most users of major BNPL services can be considered high risk as they typically have lower income levels, educational attainment levels and credit card ownership rates than the national average (Payments Dive 2023).

As the industry develops, many BNPL providers are adopting cutting-edge features to elevate user experiences. Ratio Tech uses artificial intelligence (AI) to offer customized payment options based on customer data and behavior patterns – these tools help drive conversions while creating a smoother journey for consumers.

Getting Started with Ratio Tech’s BNPL

Implementing BNPL Solutions for Your Business

For companies interested in exploring Ratio Tech's BNPL solutions, the process begins with understanding the specific financial needs and sales cycles of the business. Ratio Tech works closely with new clients to assess their operations and tailor the BNPL services to best fit their models. The key steps include:

-

Initial Consultation: Discuss your business model and financial needs with Ratio Tech’s experts.

-

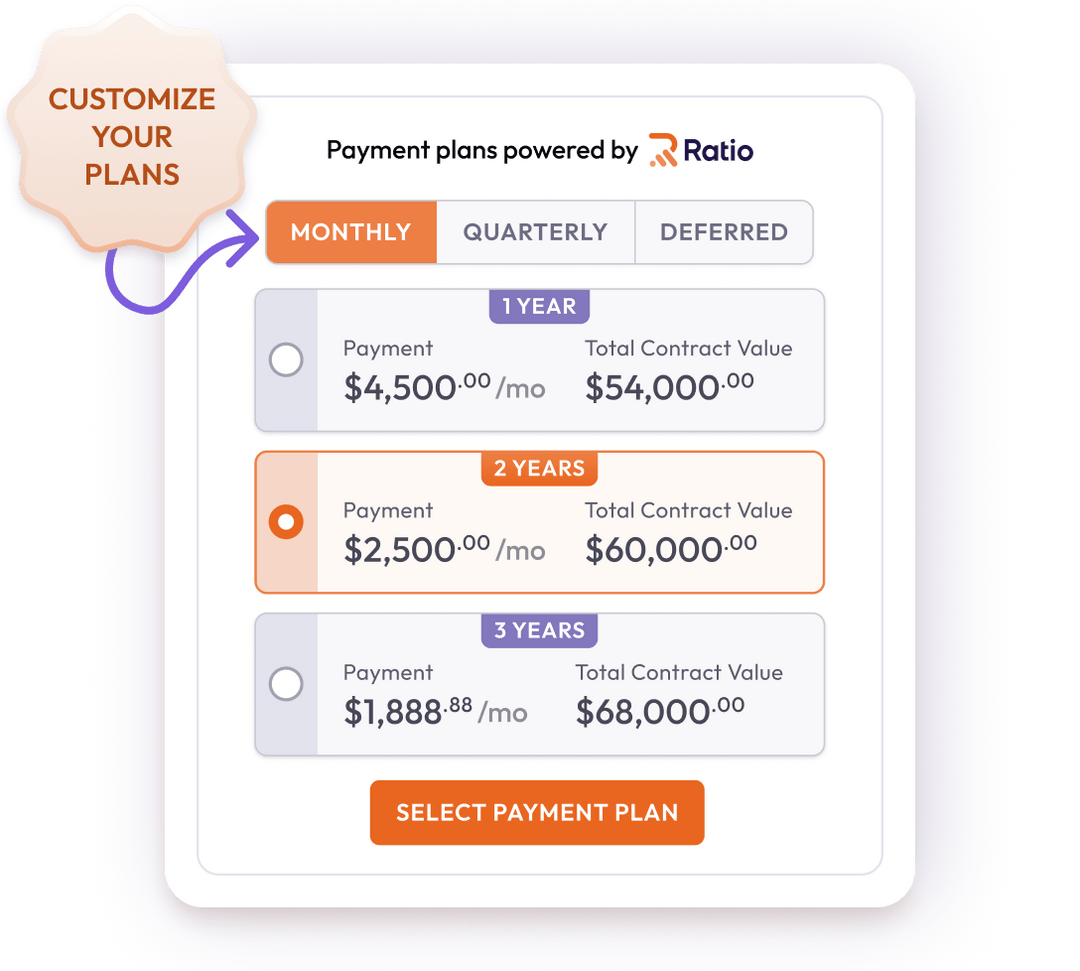

Customization: Ratio Tech tailors BNPL solutions that align with your business operations and customer base.

-

Integration: Implement the BNPL solutions seamlessly into your existing sales and financial systems.

-

Training and Support: Ratio Tech provides comprehensive training for your team to ensure smooth adoption and offers ongoing support to address any operational issues.

Companies using Ratio Tech's BNPL solutions can expect not only to enhance their sales process but also to experience an uplift in customer satisfaction and retention through more flexible payment options. Engaging with Ratio Tech's expert team can transform how businesses manage sales and finance, paving the way for accelerated growth and financial resilience.

Redefining Flexibility: How BNPL Empowers SaaS and Hardware Sales BNPL helps B2B buyers close sales faster and increase their ACV more easily by making annual subscription plans more cost-effective, eliminating the need for merchants to offer significant discounts or face an unpredictable cash cycle. BNPL also appeals to younger, digital-native consumers who value flexibility and financial…

Recent Posts

- Stone Grove Digital Elevates Indianapolis Businesses with Premier SEO Services

- Stone Grove Digital Elevates Indianapolis Businesses with Premier SEO Services

- Black Bear Roofing & Exteriors: The Leading Provider of Roofing Services in Springfield

- Black Bear Roofing & Exteriors: The Leading Provider of Roofing Services in Springfield

- Impact Orthodontics: Revolutionizing Smiles in Calgary with Cutting-Edge Orthodontic Care